What Does Mortgage Brokerage Do?

Wiki Article

The smart Trick of Mortgage Broker That Nobody is Talking About

Table of ContentsMortgage Broker Salary Fundamentals ExplainedA Biased View of Mortgage Broker SalaryThe 5-Second Trick For Mortgage Broker AssistantThe Mortgage Broker Assistant Job Description PDFsWhat Does Mortgage Broker Meaning Mean?A Biased View of Mortgage Broker AssistantNot known Details About Mortgage Broker Average Salary The Single Strategy To Use For Mortgage Broker Average Salary

It is necessary to be diligent when employing any specialist, including a mortgage broker. Some brokers are driven exclusively to shut as numerous finances as possible, thus endangering solution and/or values to secure each deal. Likewise, a home mortgage broker will not have as much control over your loan as a large financial institution that underwrites the car loan in-house.Among the most complex parts of the home mortgage procedure can be figuring out all the different kinds of loan providers that sell home mortgage and refinancing. There are straight lending institutions, retail loan providers, mortgage brokers, profile loan providers, correspondent lenders, wholesale loan providers as well as others. Several consumers merely head right into the process and also seek what appear to be affordable terms without fretting concerning what kind of loan provider they're handling.

How Mortgage Broker Assistant Job Description can Save You Time, Stress, and Money.

The majority of portfolio loan providers tend to be straight lending institutions. As well as numerous loan providers are included in even more than one type of borrowing - such as a large bank that has both wholesale and also retail financing procedures.Home loan Brokers A great place to begin is with the difference between home mortgage loan providers and home mortgage brokers. Home loan lenders are precisely that, the lenders that really make the funding as well as supply the cash utilized to purchase a house or refinance a current home mortgage. They have specific criteria you need to satisfy in regards to creditworthiness and also funds in order to get a funding, and also established their mortgage passion prices as well as various other funding terms accordingly.

The Greatest Guide To Mortgage Broker Vs Loan Officer

What they do is collaborate with numerous lending institutions to find the one that will offer you the most effective rate and also terms. When you take out the car loan, you're obtaining from the loan provider, not the broker, who merely functions as an agent. Frequently, these are wholesale loan providers (see listed below) that mark down the rates they supply via brokers contrasted to what you would certainly get if you approached them straight as a retail consumer.Wholesale and also Retail Lenders Wholesale lenders are banks or various other institutions that do not deal directly with consumers, but use their financings via 3rd parties such as mortgage brokers, cooperative credit union, other banks, etc. Typically, these are huge banks that likewise have retail operations that work with consumers directly. Numerous large financial institutions, such as Financial institution of America and Wells Fargo, have both wholesale and also retail operations.

See This Report on Broker Mortgage Calculator

The crucial difference below is that, as opposed to offering fundings with middlemans, they offer cash to banks or other mortgage lending institutions with which to issue their very own finances, on their own terms. The warehouse loan provider is settled when the mortgage lending institution sells the loan to capitalists. Home loan Bankers Another difference is in between profile loan providers as well as home mortgage bankers.

Facts About Mortgage Broker Assistant Revealed

This makes portfolio lending institutions a great option for "specific niche" consumers who do not fit the normal lending institution account - possibly because they're seeking a big loan, are considering a special home, have actually flawed credit rating however solid finances, or might be looking at financial investment property. You might pay greater prices for this solution, however not always - due to the fact that article source profile lending institutions official source often tend to be extremely careful who they lend to, their prices are sometimes quite low.Difficult money lending institutions often tend to be exclusive people with cash to provide, though they might be established as organization operations. Rates of interest have a tendency to be rather high - 12 percent is not unusual - as well as down repayments might be 30 percent and also over. Hard money lenders are generally made use of for short-term fundings that are expected to be paid back promptly, such as for investment residential or commercial property, as opposed to long-lasting amortizing fundings for a residence acquisition.

The smart Trick of Mortgage Broker That Nobody is Talking About

Again, these terms are not always special, yet rather normally define sorts of home loan features that various lenders may carry out, often at the same time. Yet understanding what each of these does can be a great assistance in understanding exactly how the mortgage process works and create a basis for assessing home loan deals (mortgage broker salary).I am opened up! This is where the content goes.

Little Known Questions About Mortgage Broker Assistant Job Description.

Let's dig deeper right into this process: The very first step to take when getting a home in Australia is to get a declaration from the bank you are obtaining from, called pre-approval (please inspect this message to recognize exactly how the pre-approval jobs in information). To be able to do that, you first require to discover a financial institution that settles on lending you the money (mortgage broker association).

Not known Facts About Mortgage Broker Salary

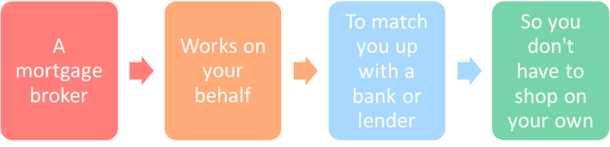

Making use of a home loan broker gives you many even more options. Not just when it comes to finest car loan deals, however also for conserving time and staying clear of errors that could obtain your lending refuted.

Report this wiki page